Analysis: The Changing Softwood Lumber Market in China

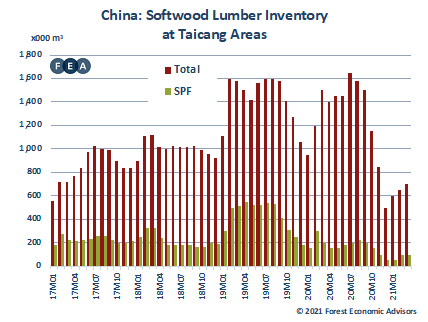

According to the statistics released by China Customs, China’s import volume of softwood lumber decreased by nearly 10% in 2020. Furthermore, there has been a decline of 23% in the first two months of this year compared with the same period of last year, compounding the very low lumber inventories in China from the end of 2020. The current softwood lumber inventory at Taicang was at 700,000 m3 at the end of March, well below the average normal inventory of 800,000 – 1 million m3 in previous years.

In terms of Canadian SPF, the inventory stayed at 90,000 m3 at the end of March, a dramatic decline from around 500,000 m3 back in 2019H1. The record price run of SPF in the US market has exerted upward pressure on prices in China markets since last summer. As of the end of March, the new offer price of SPF lumber 2×6 #3 grade had to reach US$486 CFR China ports if converted from the price sold to the US market, however, the deal price of 2×6 #3 grade SPF was at around US$240 CFR China ports. The huge premiums in the US market are expected to limit the volumes that Canadian producers offer to China in the months ahead. During the last several months, almost NO volumes of high grade (#2 and better, and J grade) have been offered in China market, and most recently, the offer volume of 2×4 #3 grade of SPF is not available in the Chinese market as well.

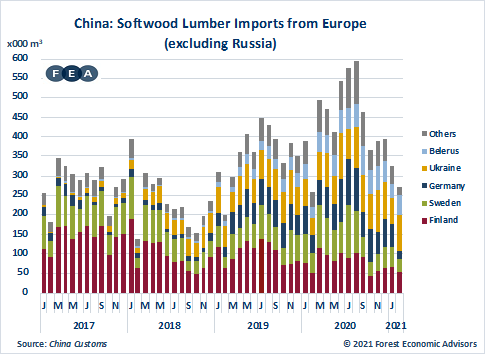

Not only from Canada, China’s softwood lumber imports from other main suppliers also showed rapid declines, especially for high-grade lumber supplied from Russia, Finland, Swedish, Chile, and New Zealand. However, the supplies from Ukraine and Belarus (mostly for low-end construction lumber application) had strong growth in 2020 and continued the upward trend in the first two months of this year. Currently, Ukraine was the largest softwood lumber supplier from Europe (excluding Russia) to China in 2020.

It’s certain that the Chinese market is facing a tough challenge of tight supplies and extremely prices of softwood lumber, and this situation has been forced Chinese lumber distributors and wood products mills to look for substitution options. There are several solutions emerging in China, and one of the most practical options is using imported softwood logs to produce lumber products by Chinese domestic sawmills. Compared with the soaring prices of softwood lumber, the prices of softwood logs were at a relatively moderate growth, and the supply volumes remained steady with high inventories currently at Chinese ports. As a result, Chinese mills have been using more imported logs to produce lumber products for non-construction applications to fill the import-lumber supply gap while also having cost advantages versus using imported timber. Currently, it’s estimated that more than 30% of European spruce logs in the Shandong province (Qingdao and Lanshan ports) and 50% of European spruce logs in the Putian port are being cut to produce furring strips, pallet/packing lumber, or low-grade wall panels/bed slats. This is a new trend given that historically, over 90% of European spruce logs were used for construction lumber applications. Of note, because of the limitation on KD facilities and high KD cost, the lumber products made from Chinese domestic mills normally don’t have the right moisture content or are just air-dried.

Due to the low grade of imported logs and poor KD quality in China, it’s hard to fit the quality requirements for the high-end applications with the imported softwood logs cut into lumber at Chinese mills. These applications include sauna panels, clear-grade wall panels, clear FJ & EG panels, furniture products, etc. These applications are typically produced from SF grade lumber from Russia and Europe, furniture grade lumber from Southern Hemisphere, and #2 & better grade from Canada. Moreover, the CFR price offers for spruce lumber have already exceeded US$400/m3 for SF grade from Russia and Europe, in contrast to the previous high of US$290/m3 back in mid-2018. Therefore, the end-users have to look at other substitution options, specifically:

- Some Chinese mills are switching over to use hardwood species, such as rubber wood and Okoume, to replace the high grade of imported softwood lumber used in appearance components. Currently, the relative price differential of some hardwood species and softwoods is decreasing, making these hardwoods an attractive substitute as the final products made from these hardwood species can be sold at higher prices than softwood.

- Some Chinese furniture mills are using wood-based panel products to produce panel furniture instead of solid wood furniture. This lowers the overall cost of these furniture items to meet a lower-cost, market niche price level.

Meanwhile, more Chinese domestic species, such as Chinese fir and Mason pine are now being used for pallet/packaging lumber, fences, and other low-end applications. However, the supply volume is still very limited in the short term. It will still take a much longer time to have domestic timber supplies fit the market demands in terms of log diameter, labor skills, supply chain, etc.

Going forward, it seems there will be no big improvement on softwood lumber supplies to China in the short term. China’s softwood lumber market is changing with a new structure of supplies and new volume & cost balance between import lumber and lumber products made from imported logs by Chinese mills.