China Economic Update 2020 Q4

China’s gross domestic product (GDP) expanded 6.5% year-on-year in Q4 2020, following 4.9% growth in the third quarter. Despite a complicated year with all the implications of COVID-19, China’s economy ended in remarkably good shape and remains poised to expand further this year. Although some analysts expected the economic growth to rebound to 8.4% in 2021, others cautioned that a recent outbreak of COVID-19 cases in China could impact activity and consumption in the run-up to the Lunar New Year holiday. While the Lunar New Year break officially runs from February 11th to the 17th, lockdown policies are expected to intensify around the holidays as people travel to and from their hometowns. Often cited as the largest human migration on earth, this holiday sees hundreds of millions of people returning to hometowns across China to celebrate with their families. While travel and family events are currently permitted, many people are being asked to submit COVID-19 tests before and after travel. Any region with recent cases will also have further restrictions on travel, with the possibility of immediate policy changes if new cases are found. The COVID repercussions of this holiday are expected to last up into early March, given concerns about the incubation timeline for those returning to major cities.

China’s manufacturing sector continued to improve in December. The Caixin China General Manufacturing Purchasing Managers’ Index (PMI index), an important indicator of the strength of the Chinese economy, reached 53 in December[i]. (With a reading above 50 indicating an expansion in activity.) Both demand and supply in the manufacturing industry remained strong, while overseas demand improved.

In terms of the currency exchange rates, CAD/CNY fluctuated in Q4 2020. Specifically, the CAD rate showed a downward trend in the first half of Q4, slipping to the low of 5.00 RMB on November 2. In the second half of Q4 it rebounded to a high of 5.15 RMB on December 16.

2021 Economic Outlook

The Economist Intelligence Unit (EIU) expects China’s real GDP to recover to 8.7% in 2021 – following its slump to 1.8% in 2020 – underpinned by fiscal support for infrastructure, healthcare and consumption. After loosening in 2020, monetary policy will shift to a neutral stance in 2021, amid concerns of deepening structural imbalances. Restoring domestic demand will be a key theme under the “dual circulation” model, but policymakers will enjoy limited success in this area.

The International Monetary Fund (IMF) forecasts an expansion of 8.2% for China’s GDP in 2021, down a full percentage point from the IMF’s April 2020 estimate. Looking at different aspects of the economy, in 2020 fixed-asset investment rose by 2.9%, and value-added output at industrial firms increased 2.8%, while retail sales fell 3.9% and household consumption expenditure fell 4.0% year on year. Industry and investment activity have been major drivers, while consumption still shows some weakness tied to lockdowns and ongoing limits on tourism travel.

The Construction Sector

According to the National Bureau of Statistics of China (NBS), the average new home price in China’s 70 major cities rose by 3.8 percent year-on-year in December 2020, after a 4 percent rise in the previous month. This was the slowest pace of growth in housing prices since February 2016, as the government stepped up its efforts to deleverage the highly indebted sector to reduce financial risk.

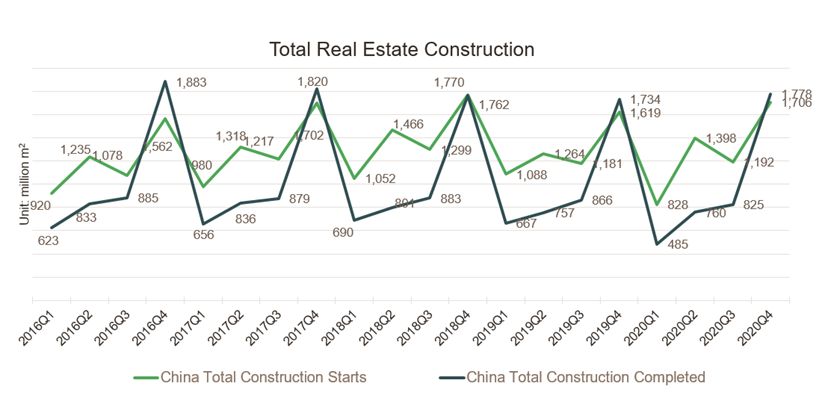

Total investment in real estate in China had a year-on-year increase of 7 percent from January to December, 0.2 percent higher than that from January to November. The total floor area completed in China in Q4 2020 was at 3.848 billion m2, up 85.9 percent compared to Q3 (2.069 billion m2).

The chart above shows the trend of total construction project starts and total projects completed in the corresponding quarter. In Q4, total construction completed rose 49.1 percent in Q4 compared with Q3, also a 2.5 percent higher than the same period in 2019.