China softwood market update

2021 Year in Review

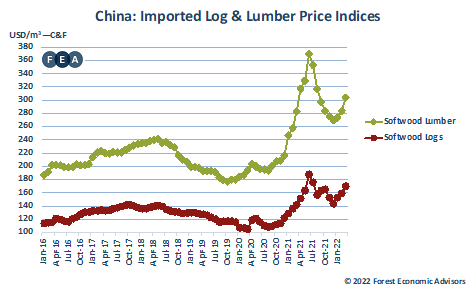

According to the statistics released by China Customs on China Log and Lumber Imports, softwood log imports had a total volume of 49.876 million m³ in 2021, and a value of $7.878 billion. This represented a year-on-year increase of 6% in volume and an increase of 44% in value compared to 2020. The average price of softwood logs increased $41 per m3. Softwood lumber had a total volume of 19.260 million m³ in 2021, valued at $4.337 billion. This represented a year-on-year decrease of 23% in volume as well as a decrease of 1% in value compared to 2020. The average price of softwood lumber increased $50 per m3. The chart below represents the average of an historic “basket” of log and lumber prices. Influenced by international markets, 2021 saw an unprecedented price spike. The price index peaked in China in June 2021.

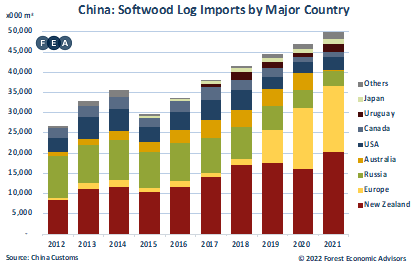

China has experienced rapid growth in softwood log imports over the past decade, with total imports increasing by 87% from 2012 to 2021. The market share of major importing countries has also changed significantly. The main supplier, Russia, saw its imports of softwood log drop from 33% to 8%. The shares of imports from New Zealand and Europe grew by 14% and 31%, respectively, during the decade. It is worth mentioning that in 2021, China cut imports of softwood logs from Australia.

China’s softwood log imports in 2021 are generally on the rise. New Zealand Radiata increased by 26% compared to 2020, which filled the annual import volume gap from Australia. European spruce imports increased by 7% compared to 2020, with new arrivals finally slowing down in 2021 Q4. Uruguay pine imports increased by 127% compared to 2020, reaching the previous record high set in 2018. Imports from North America increased by 20% compared to 2020, while SYP logs have faced new inspection requirements. Russian log imports deceased 15%, with no supplies made available in January 2022.

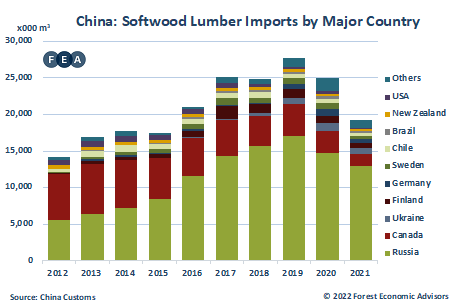

In terms of China’s softwood lumber imports, imports have increased by 35% in the last decade. Two main source countries are Russia and Canada, of which the market share for Russia increased by 28%, while the market share for Canada dropped 36% from 2012 to 2021. Ukraine’s market share increased from 0% to 5%.

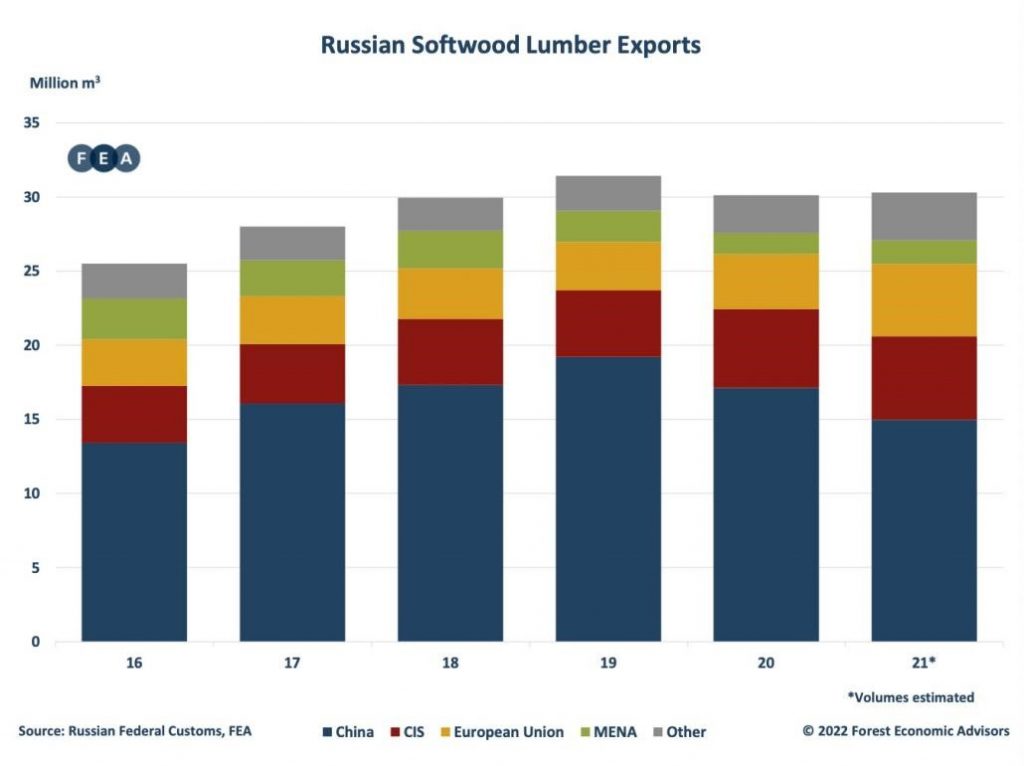

How quickly can Russia ramp up its lumber exports to China?

Policy Updates:

- Starting from July 1st 2021, Russia imposed 10% export duties (no less than €13/m3) on green softwood lumber exceeding 22% moisture content.

- Starting from January 1st 2022, Russia imposed €220/m3 export duties on green softwood lumber with 100mm+ of thickness and width.

- Russian’s softwood log export ban has been taken effective from January 2022.

- China conducts new custom clearance regulations on pine logs and lumber imports from seven countries (including Canada and the US) after February 1st, 2022.

- China suspends log imports from Lithuania after February 26th, 2022.

For those volumes shipped by Ocean ports (estimated at about 25-30% of total supplies), mostly KD lumber from North-Western part of Russia, there are more options in sales market for China. For those volumes shipped by regular wagons to land ports (estimated at about 50% of supplies), largely green lumber, they have more potential to increase the supply volume quickly, but will be restricted by the COVID-19 control measures at land ports in the short term. For those volumes shipped by BRI trains to inland ports, largely green lumber, they have been limited by the operation capacities. More importantly, the volume and rate of supply will be determined primarily by market demand and prices in China.

Beyond that, there are still some uncertainties. Lumber shipments from North-Western part of Russia via ocean ports are likely to have some problems regarding the container availability and payment terms. However, there will have potential to increase the lumber shipment from Russia to China via railway (using regular wagons or BRI trains, or rail + ocean from Vladivostok). Russia will potentially have more volume available for Chinese market, from those supply losses to Europe/Japan/South Korea (estimated at 6 million m3 in total in 2021). A weaker currency will push Russian timber to be more competitive in the Chinese market with lower costs.

Near-term Summary

Same as last year, there are still many concerns on the global log supplies to China, such as harvest reductions in New Zealand and Europe; fewer arrivals from South America given the high shipping cost; almost no supplies of SYP due to the new regulation and no supplies from Russia and Australia. Moreover, the SPF and SYP lumber imports from North America is predicted to further decline in the coming months due to the new inspection regulations for Pinewood Nematode (PWN). All those supply constraints have resulted in a rapid growth of C&F prices offered from international suppliers in January and February this year. Recent RMB currency appreciation has been helpful for Chinese companies to accept higher C&F prices offered by overseas suppliers, either in US$ or Euro. Higher prices accepted in China could drive higher volume shipped to China in the coming months.

Lumber shipments from Ukraine and Belarus to China have been severely impacted by the current conflicts between Russia and Ukraine. In addition, European lumber supplies to China will be limited as well, as the European market will reduce imports of Russian supplies, and European exports will fill that market. Russian lumber supplies are expected to have higher volume and competitive prices available for the Chinese market in the coming months. However, there are still many uncertainties, mainly with ongoing logistics issues. Therefore, it is difficult to predict how much and how fast the supply of Russian lumber to the Chinese market will grow.

In addition to those supply issues, there is also uncertainty on the consumption side in China. Chinese wholesale market price has risen quickly as predicted right after the spring festival, but it began to fall at the end of February. The consumption demands from end-user sides was weak, and the sawmill operation rate is at around 30-40% (six-weeks after the Spring festival). The policy loosening to accelerate real-estate loans and ensure growth in both residential mortgages and loans to developers over the next few months could lead to the positive construction activities and timber consumption growth soon. Despite the weak demand and high inventories (for both logs and lumber), Chinese importers and distributors do expect the prices remaining high given the prediction of low new arrivals in recent months. The alternative solutions will play an important role in 2022.

*This Report is compiled with permission from a presentation by Jane Guo, FEA