South Korea Economy and Housing Market Update for Q1 of 2022

1st Quarter of 2022 – South Korea Economy:

South Korea’s economy expanded by a lackluster 0.7% in Q1 of 2022, compared with Q4 of 2021, weighed down by the spread of omicron and risks stemming from the Ukraine crisis.

- Exports increased 4.1% in Q1 driven by strong outbound shipments of semiconductors, coal and petroleum products.

- Imports inched up 0.7% on increased imports of crude oil.

- Private consumption fell by 0.5% in Q1

- Facilities investment declined 4% in Q1

2022 Growth Outlook:

- IMF lowered 2022 growth outlook for the South Korean economy to 2.5%, while raising the inflation projection to 4% in 2022.

- Inflation has been under upward pressure due to a hike in fuel prices and a rebound in demand from the pandemic.

- The economy in 2022 will continue its recovery through solid exports and recovery in private consumption, but will be hampered by the Ukraine crisis.

Political changes:

President Yoon Suk-yeol was elected the 20th democratic leader of South Korea on March 9 for a single, five-year term until May of 2027.

What Yoon pledges to do as president:

- COVID-19 economic rescue

- Creating sustainable, good jobs

- 2.5 million new homes

- Government, presidential office reform

- Strengthening science, technology

- More support for childbirth, childcare

- Creating a fairer society, abolishing the Gender Ministry

- Confident diplomacy, strong security

- Bolstering nuclear energy, realizable carbon neutrality initiatives

- Fair education, culture welfare

Nationwide local elections were followed on June 1 to elect mayors, governors, local council members and regional education chiefs and the Conservative Party registeredbig wins over the Democratic Party.

South Korea Housing & WF Construction

Real Estate Market Conditions & Government Policy Responses:

Yoon administration vows to ease the heavy-handed real estate policies imposed by the previous Moon administration, which has failed to cool down the heated housing market. New policies will include:

- Easing the cap on presale prices of privately built apartments

- Alleviating heavy-handed tax measures on multiple homeowners

- Reorganizing the acquisition tax to ease the heavy burden

- Lifting regulatory measures on the renovation of apartments

- Establishing a roadmap to supply 2.5 million new houses and relax house-related taxes

1st Quarter of 2022 – South Korea Housing Starts and Permits:

A series of failed policies by the former Moon administration to tame South Korea’s housing market was at the center of the presidential election debate.

South Korea’s Housing Starts in number of units and total floor areas for Q1 of 2022 decreased 34.8% to 84,108 units and 33.4% to 7.55 million square meters respectively from a year earlier.

1st Quarter of 2022 – South Korea WF Construction:

Due to the sharp rise in the price of building materials, the market for all residential buildings, including wood residential buildings, is shrinking.

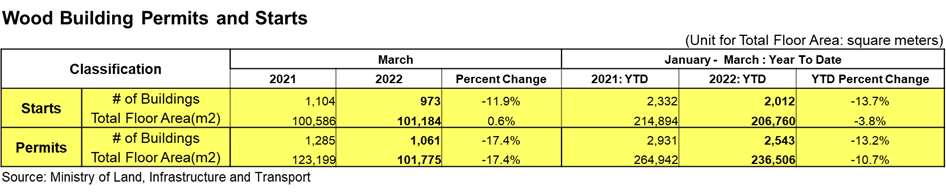

The number and total floor area of Wood Building Starts for Q1 of 2022 decreased 13.7% to 2,012 buildings and 3.8% to 206,760 m2 from a year ago and those for Wood Building Permits also decreased 13.2% to 2,543 buildings and 10.7% to 236,506 m2.

Lumber Trade between South Korea and Russia:

- According to Bloomberg News, timber exports to 48 countries designated as unfriendly were suspended including Korea and foreign patent protection in Russia was also suspended.

- Russian products account for about 20% of the domestic timber market, so a price surge is inevitable for the time being.

- The Korean government said that uncertainty exists because there is no specific list of items banned by Russia.

- Currently, “lumber” is not included in Russia’s export-prohibited items to Korea, but imports of Russian lumber face hurdles due to difficulties in international trade and logistics, fluctuations in exchange rates, etc. due to Korea’s participation in sanctions against Russia.

- Korean industry is closely watching the ripple effect.

- The domestic timber industry is replacing Russian lumber with German-made lumber.

- Russian lumber imports still logged a 26% increase as of March 2022, since shipments for March were already enroute and April arrivals were at the docks. Many observers predict the true impact of the sanctions against Russia will become clear in June and July, with imports from Europe falling anywhere from 10% to 40%.

- Most of Russian lumber is used for non-structural applications in Korea, therefore, lumber from Chile, New Zealand, and Brazil will gain immediate advantage as will European lumber including Germany, Finland and Austria.

- But if the banis protracted, CDN lumber will also benefit in the medium-to-long term.

CEO Song Moon-ho, representing a company importing Russian lumber, said, “There is no payment being made in Russia, so all trade has stopped except for some preordered quantities. To fill the gap for the Russian spruce lumber, we plan to import German spruce logs for the time being, and 70% of lumber imports will be supplied as dry lumber, and 30% as non-dried lumber. But the market supply for dried lumber, which accounts for 70% of overall demand, will face a serious shortage.”