South Korea Economy and Housing Market Update for the 1st Quarter of 2021

Economy:

South Korea’s first-quarter economic growth in 2021 is widely estimated to have recovered to pre-pandemic levels on a rapid rebound in exports and investment.

South Korea’s GDP expanded at a faster-than-expected pace to 1.8% in the first quarter of 2021 from a year ago, buoyed by a modest recovery of exports and government policy support.

Exports hit a record high in the 1st quarter as shipments of chips and autos remained robust amid the pandemic standing at US$145.5 billion, up 12.5% from a year earlier.

Facility investment jumped 12.4% on-year in the 1st quarter from a year ago, when the economy grappled with the pandemic crisis, while construction investment fell 2.4%.

Private consumption rose 1% on-year in the 1st quarter, while government spending gained 2.6%. However, construction investment fell 2.4 percent on-year.

The Bank of Korea has projected South Korea’s economy to grow 3% on-year in 2021, with consumer prices increasing 1.3%. In addition, the International Monetary Fund recently raised its growth outlook for South Korea this year to 3.6%.

The biggest hurdles to reaching this year’s economic growth targets will be South Korea’s countermeasures against a resurgence of coronavirus infections and the speed of its vaccination program.

Housing & Wood-Frame Construction:

South Korea’s soaring housing prices have shown no signs of a slowdown despite the government’s efforts to stabilize the real estate market, including tax hikes and loan regulations. Prices of houses for rental recently spiked as supply dried up.

As housing stability is one of the government’s central policies, the construction ministry will prioritize increasing housing supply by relaxing construction regulations in densely populated urban areas and supporting redevelopment projects to boost supply.

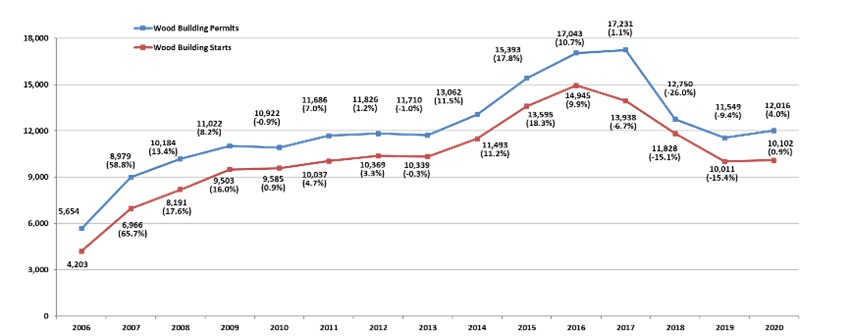

Year on year wooden building starts and permits for 2020 increased 0.9% and 4% to 10,102 buildings and 12,016 buildings respectively after a consecutive three-year decline starting in 2017.

The share of wooden homes in total single-family housing starts to increase to a record high of 14.2% in 2020. This was largely driven by the working from home lifestyle due to the pandemic.

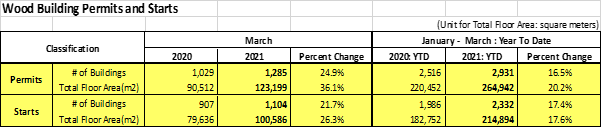

South Korean total housing starts and permits by buildings for Q1 2021 increased 13.1% to 14,933 buildings and 14.8% to 17,669 buildings respectively from a year earlier. The number of buildings and floor area of Wood Starts for Q1 of 2021 increased respectively by 17.4% to 2,332 buildings and 17.6% to 214,894 m2 versus 2020. Wooden Permits also demonstrated growth reaching 2,931 buildings (+ 16.5%) and 264,942 m2 (+ 20.2%).

Demand for remodelling and renovation upgrades such as new decks, gazebos, fences and other home additions have soared. The notion that a well-ventilated indoor environment can help reduce the transmission of the virus has also driven interest in premium healthy homes with filtration and energy recovery systems, previously avoided due to their high cost. Such systems are a mandatory requirement in Passive or Super-E® certified units.