South Korea Economy and Housing Market Update for the 2nd Quarter of 2021

Economy

The South Korean economy is on a recovery track on the back of solid exports and improving domestic demand. It contracted 0.9% in 2020 due to the fallout of the pandemic.

South Korea’s GDP grew 0.8% in the 2nd quarter from three months earlier.

Exports jumped 39.7% to US$54.8 billion on-year in June on the back of a recovery in global business activities, which led to stronger demand for chips and automobiles, while imports also climbed 40.7% to $50.3 billion, resulting in a trade surplus of $4.44 billion in June and marking the 14th consecutive month for the country to post a trade surplus.

Private spending rose 3.5% on-quarter in the 2nd quarter, the sharpest expansion in 12 years.

The government raised its 2021 growth outlook for the country’s economy to 4.2%, up from its earlier estimate of 3.2%, citing a solid recovery in exports and facility investment.

But the latest resurgence in COVID-19 cases and the fast spread of the delta variant are feared to dampen improving private spending, possibly sapping economic recovery momentum.

To help prop up the pandemic-hit economy, the government unveiled a record 604.4 trillion won (US$521 billion) budget plan for 2022.

Housing & WF Construction

Panic-buying in the property market is expected to go on for the time being on the back of eased loan regulations for first-time buyers that started from July 2021, coupled with a shortage of Jeonse apartments, a type of arrangement that involves the tenant giving the landlord a large sum of “key money” when a lease is signed.

To cool down the heated market, the South Korean government will continue efforts to increase the supply of affordable housing and crack down on speculators and those who manipulate the housing market.

The government plans to provide a total of 830,000 additional housing units by 2025 through public sector development aimed at ameliorating the housing shortage and slowing the upward trend of housing prices.

Due to supportive government policies and increasing demand, South Korea’s Housing Starts and Permits expressed in number of buildings and total floor areas for Q2 of 2021 increased markedly from a year earlier.

- Housing Starts in number of buildings and total floor areas for Q2 of 2021 respectively increased 16.6% to 36,804 buildings and 26.1% to 22.358 million square meters respectively from a year earlier.

- Housing Permits in number of buildings and total floor areas for Q2 of 2021 increased 21.2% to 42,205 buildings and 30.2% to 26.961 million square meters respectively from a year earlier.

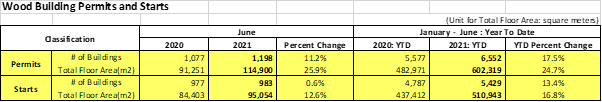

The number and total floor area of Wood Building Starts for Q2 of 2021 considerably increased 13.4% to 5,429 buildings and 16.8% to 510,943 m2 from a year ago and the those for Wood Building Permits remarkably increased 17.5% to 6,552 buildings and 24.7% to 602,319 m2.

The growth of WF construction is against the backdrop of the record high prices for wood products such as SPF structural lumber and OSB panels.

The increases are due to successful building code evolution and continued tech transfer on seismic design for small-scaled buildings coupled with the increasing demand for single-family homes in low-density environments plus healthy home options.