China Economic Update 2021 Q2

China’s Gross domestic product (GDP) expanded year-on-year by 7.9% in the second quarter of 2021. Monthly data, including retail sales, industrial output and fixed investments, showed growth softened but not as much as expected, adding to views that policymakers may do more to support the recovery. Higher raw material costs, supply shortages and pollution controls are weighing on industrial activity. The People’s Bank of China (PBOC) has announced that it would cut the amount of cash that banks must hold as ratio reserve requirements (RRR) by 0.5 percent, which would release about 1 trillion RMB in cash. This signals that the central government is becoming more concerned with economic recovery in the private sector, with this RRR cut expected to free up liquidity that could help banks deal with pressures arising from deteriorating asset quality, as well as the impact of the pandemic and wealth management product reforms.

Outbreaks of new cases of COVID-19 have been associated with lagging performance in consumer spending. The Delta variant of COVID-19 was dominant in those infections in the Guangdong province upsurge, which also caused delays in some of the major ports in Guangdong. The two-year average growth in retail sales remains below pre-pandemic trends, which is evidence of persistent weakness in domestic private consumption. Household income growth also remains outpaced by GDP, even as average working hours have increased in recent months.

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI index) expanded at a softer pace in June, coming in at 51.3 (with a reading above 50 indicating an expansion in activity). Despite edging down to a three month low, the June reading marked the 14th consecutive month of expansion. Surveyed companies indicated that the recent uptick in COVID-19 cases and supply chain difficulties weighed on output, while the pandemic dampened demand both at home and abroad. Inflationary pressures eased somewhat, but manufacturing enterprises’ purchasing prices and factory-gate prices still rose. Secondary industrial value-added (IVA) output increased by 14.8% year on year, driven by pharmaceutical, metal making and electronics manufacturing, while automotive output contracted by 16.5% due to microchip shortages and the switch to new emission standards that showed a better performance for new-energy vehicles.

In terms of the currency exchange rates, CAD/CNY showed strong momentum in Q2 2021. Specifically, the exchange rate reached the half-year peak of 5.33 on May 18.

2021 Economic Outlook

The Economist Intelligence Unit (EIU) under the Economist Group maintains their expectations that China’s real GDP will be around 8.5% in 2021, up from 2.3% growth in 2020. However, the continuous momentum has waned due to the government having toned down policy support as the pandemic is brought under control. COVID-19 vaccination has accelerated, and current expectations are that 60% of the population will be fully vaccinated by the second quarter of 2022.

The International Monetary Fund (IMF) also maintained their forecasts that China’s economy will grow 8.4 percent in 2021 this year, with global growth of 6%. Both the United States and China are seeing a rapid rebound from the economic damage brought on by the COVID-19 pandemic. The IMF noted that China’s effective containment measures, strong public investment response and central bank liquidity support contributed to the strong recovery. Ongoing fiscal support will be targeted, likely to focus on major infrastructure projects such as the Yangtze River Delta integration targets, and the Greater Bay Area city clusters.

The Construction Sector

According to the National Bureau of Statistics of China (NBS), the average new home prices in China’s 70 major cities grew 0.5% in June 2021 from a month earlier. Tightening credit conditions and existing curbs have helped rein in rising housing prices.

New-home prices rose in 55 out of 70 surveyed cities in month-on-month terms in June, according to data released by the National Bureau of Statistics. This compares with 62 in both May and April. Some lenders were reported to have slowed down loan approvals or even suspend their mortgage business, as central bank orders for banks to raise mortgage rates and other administrative controls worked to manage housing price increases.

The volume of sales for newly-started projects has increased significantly in the first five months of the year to date, with the National Bureau of Statistics reporting a 29.4% increase in residential sales volume as measured by total area, along with a 10% increase in commercial properties. Total investment in real estate in China had a year-on-year increase of 15 percent from January to March.

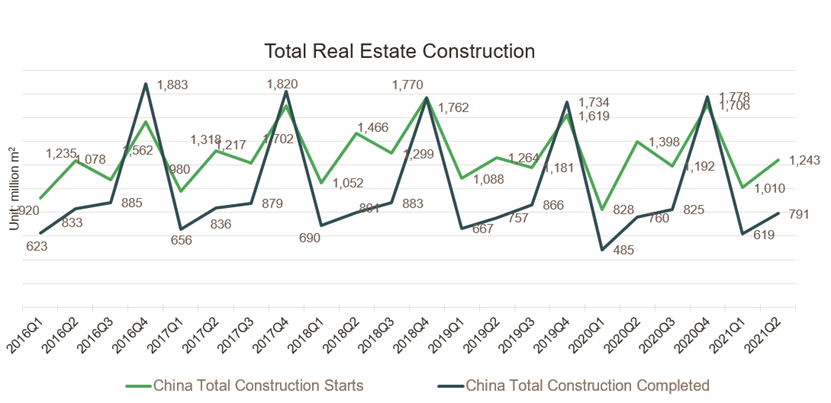

The chart above shows the trend of total construction project starts and the total projects completed in the corresponding quarter. Total floor area completed in China in Q2 2021 was at 791 million m2, up 27.8 percent compared to Q1 2021 (619 million m2), growing 4 percent compared to the same period in 2020 (760 million m2).