South Korea Economy and Housing Market Update for Q2 of 2022

2nd Quarter of 2022 – South Korea Economy:

The economy of South Korea grew faster in the second quarter of the year on the strength of private spending, as a result of the easement of COVIC-19 restrictions, despite the fall in imports..

• GDP grew 0.7% in Q2 upticking from a 0.6% increase in Q1.

• Consumer spending rose 3% in Q2 as spending on semidurable goods and in-person services, such as accommodations and restaurants, increased with eased COVID-19 restrictions.

• Government spending increased 1.1% in Q2 due to increased fiscal stimulation aimed at coping with the pandemic.

• Exports shrank 3.1% in Q2, compared with a 3.6% increase in Q1 amid heightened external economic uncertainty from the protracted war between Russia and Ukraine, and China’s COVID-19 lockdowns.

2022 Growth Outlook:

• South Korea’s economy faces a risk of stagflation, a mix of elevated inflation and slowing growth.

• Consumer prices soared 6% in June from a year earlier, the fastest clip in nearly 24 years accelerating from a 5.4% on-year spike in May.

• South Korean government lowered its 2022 economic growth outlook to 2.6%, while sharply raising this year’s inflation outlook to a 14-year high of 4.7%.

South Korea Housing & WF Construction:

Real Estate Market Condition & Responding Government Policies:

• Yoon administration will unveil its first package in September intended to stabilize the housing market that includes initial steps on the supply of more than 2.5 million new houses.

• President Yoon earlier vowed an overhaul of real estate policy, saying the previous administration’s pursuit of tougher regulations and heavier taxes to curb speculation ended up causing a surge in housing prices.

• Home prices showed downward trends in recent months as housing transactions remained sluggish amid rising interest rates and concerns about an economic slowdown.

2nd Quarter of 2022 – South Korea Housing Starts and Permits:

• South Korea’s Housing Starts in number of units and total floor areas for Q2 of 2022 decreased 30% to 188,449 units and 21.2% to 17.62 million square meters respectively from a year earlier.

• However, owing to the Yoon administration’s policy toward small sized housing for the first-time home buyers, newlyweds, low-income people and young generation, Housing Permits in number of units and total floor areas for Q2 of 2022 increased 12.6% to 259,759 units and 18.8% to 32.02 million square meters respectively from a year earlier.

2nd Quarter of 2022 – South Korea Wood Frame Construction:

• Due to the sharp rise in the price of building raw materials, the market for all residential buildings, including wood residential buildings, shrank.

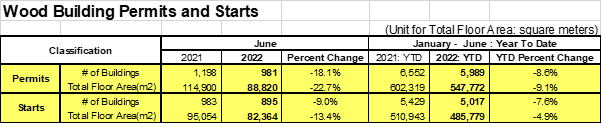

• The number and total floor area of Wood Building Starts for Q2 of 2022 decreased 7.6% to 5,017 buildings and 4.9% to 485,779 m2 from a year ago and Wood Building Permits also decreased 8.6% to 5,989 buildings and 9.1% to 547,772 m2.

Lumber and OSB Shipment to South Korea in Q2 of 2022:

South Korean demand for Canadian Lumber has fallen steadily in recent years while producers in Chile (17.8% increase in Q2), Russia (7.5%), New Zealand (108.6%), Germany (7.5%) and Brazil (22.3%) have captured a growing share.

Canadian Lumber shipments to South Korea continued to lose ground in the first half of 2022 falling by double-digit percentages (38.6% decrease in Q2 based on KFS’ Statistics of Forest Product’s Trade data).

Buyers in South Korea sought OSB from exporters in Canada, but Canadian OSB shipments to South Korea were continued to be limited in the first half of 2022 showing 92% decrease (0.33 million sf, 3/8” basis).