South Korea Economy and Housing Market Update for the 3rd Quarter of 2021

Economy:

South Korea’s economy has expanded at a slower-than-expected pace in the 3rd Quarter of 2021 due to lacklustre private consumption despite a recovery in exports.

The economy grew only 0.3% in the 3rd Quarter, compared with a 0.8% growth in the 2nd Quarter and the corresponding figure of 1.7% in the 1st Quarter, due to a resurgence of the COVID-19 virus which caused a slump in private consumption and disruption in the global supply of automotive chips and construction materials.

Private consumption in the 3rd Quarter fell 0.3% vs. the previous 3 months, compared with a 3.6% gain in Q2 over Q1.

Exports overall grew 1.5% in Q3 driven by overseas demand for coal, oil and machinery products, recovering from a 2% drop inQ2. Imports, on the other hand, shed 0.6%, over the same period.

Housing & WF Construction:

The number of wood building starts and permits in 2020 showed signs of recovery, increasing 0.9% and 4% to 10,102 buildings and 12,016 buildings respectively, following a 3 year decline from 2017. Market growth can be attributed in part to timely code and standards efforts by Canada Wood Korea, especially in the development and promulgation of the Small Scaled Building Code-Timber Structure and training programs building knowledge capacity amongst architects and engineers.

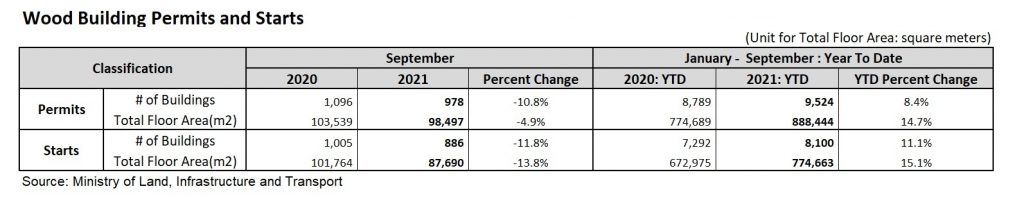

This increasing trend for wood frame construction continues in 2021. The number and total floor area of wood building starts and permits YTD September 2021 increased 11.1% to 8,100 buildings and 15.1% to 774,663 m2 and 8.4% to 9,524 buildings and 14.7% to 888,444 m2 respectively from a year ago.

The growth of wood frame construction occurred against a backdrop of record-high prices for Canadian SPF structural lumber and OSB panels.

The prolonged COVID-19 pandemic continues to drive new trends in residential construction related to healthy homes and home improvement. The pandemic has altered how many Koreans work and go to school. As a result of social distancing measures in 2020 and 2021, many people work and receive education from their homes instead of going into the office or school leading to home improvement expenditures and demand for less expensive homes in suburban areas, regardless of commuting concerns. These new trends are projected to last well into 2022 as many workers will continue to work from home despite the government’s “living with COVID-19” scheme meant to bring the country gradually back to pre-pandemic normalcy.