China Economic Update 2021 Q3

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI index) rose from 49.2 in August to 50.0 in September. This indicated that business conditions were stabilizing towards the end of the third quarter, after a slight deterioration in August. Even still, the September reading was the second-lowest recorded in the past 17 months. Supply in the manufacturing sector continued to shrink, with exporters struggling with high freight costs, logistics bottlenecks, and rising commodities prices. New cases of COVID-19 in several regions and shortfalls in raw material supplies slowed production at manufacturing companies. With the fourth wave of the pandemic overseas, demand was relatively weak as new export orders were reduced in September. Global shipping capacity was also significantly lacking, with constraints on available containers, waiting times for unloading, and shortages of truck drivers to move containers from the ports. In terms of the currency exchange rates, CAD/CNY fluctuated sharply in Q3 2021.

2021 Economic Outlook

The Economist Intelligence Unit (EIU) under the Economist Group expects that China’s real GDP will be around 7.9% this year, and will lower to 5.3% in 2022. Growth concerns may prompt the government to adopt a looser policy stance in the interim, as multiple sectors have experienced new regulatory constraints. In China, the emphasis in media such as Xinhua was on GDP expanding 9.8 percent y/y over the first three quarters of this year, to balance the negative message on growth falling below 5% in a single quarter. Covid-19 recurrences, supply chain disruptions and power strains will continue to weigh on economic activity in late 2021.

The power constraints have been a high-profile topic, with blackouts experienced across different regions that affected both local and international companies, as well as residents. Since August, at least 20 out of China’s 31 provinces have implemented power rationing to steady electricity supply, which has been hampered by coal shortages and aggressive energy consumption curbs to meet emissions targets. Part of this stems from a dramatic rise in the price of thermal coal, which as surged from 671 yuan ($104) per ton to roughly 1,100 yuan ($170). Typically, those higher coal prices would have been passed on to energy consumers. But in China, electricity utility rates are capped. This mismatch has pushed less efficient power plants into heavy financial losses because higher prices and rate increase limits have forced them to operate at a loss.

During the industry-driven recovery from COVID-19 lockdowns, coal consumption had increased dramatically and regulators loosened controls on coal-intensive sectors such as steelmaking as a way to recover from the economic slowdown in 2020. As much as 90% of coal used in China is mined domestically, but mining volumes from some of China’s northern provinces have dropped by as much as 17.7%, according to the Chinese financial magazine Caijing. There has been added pressure for provinces to meet emissions annual emissions targets, even after the rise in manufacturing that helped pull China out of the economic impact of COVID last year.

The International Monetary Fund (IMF) revised down its own 2021 growth forecast for the China economy to 8 percent from 8.4 percent in its April projection, with the forecast for 2022 at 5.6 percent growth. Analysts at Nomura reduced their forecast for 2021 by half a percentage point to 7.7%, citing the number of factories that have had to cease operations either because of local energy consumption mandates or power outages due to rising coal prices and shortages. Analysts at Goldman Sachs cut their 2021 GDP growth forecast to 7.8% from 8.2%, citing “recent sharp cuts to production in a range of high-energy intensity industries.” The recovery remains uneven as private consumption continues to lag amid repeated outbreaks and major fiscal policy tightening.

Ongoing tensions with the West will continue to drive the impetus towards self-reliance for supply chains, but at the cost of efficiency. Business confidence is being challenged on additional fronts with new policy restrictions for tech, education and gaming industries along with concerns tied to the “common prosperity” campaign. A party journal called Qiushi released excerpts from a meeting of top officials in August, which shows that Xi Jinping is putting the Common Prosperity campaign at the center of his economic program. Reassurances on what this means came through quotes such as “We must… improve the people’s ability to find employment and start businesses, and strengthen their capability to get rich.” However, at the same time, it was clear that a progressive income tax reform is being considered, with the statement that “We should reasonably regulate excessive income, improve the personal income tax system, and regulate the management of income from capital.”

The Construction Sector

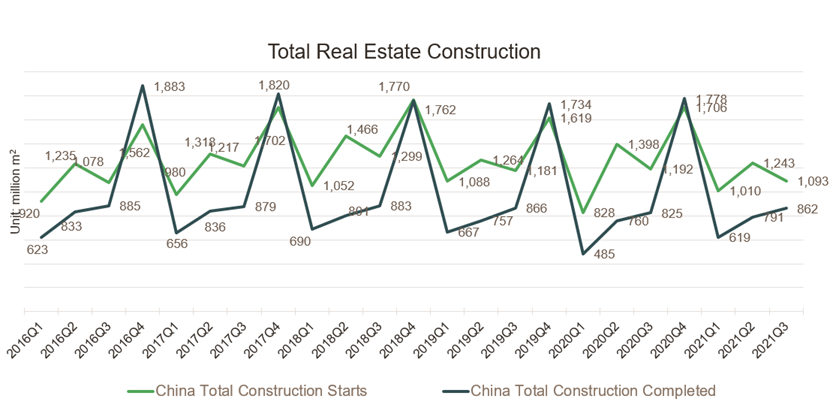

The chart below shows the trend for total construction project starts and the total projects completed in the corresponding quarter. The total floor area completed in Q3 2021 was at 862 million m2, up 8.9 percent compared to Q2 2021 (791 million m2), growing 4.5 percent compared to the same period in 2020 (825 million m2). New construction starts in Q3 are down about 21% y/y, from 1,398 million m2 down to 1,093 million m2.

According to the National Bureau of Statistics of China (NBS), the average new home prices in China’s 70 major cities stalled for the first time since February 2020 in September, with the tightening of real estate credit and lower consumer confidence being the biggest reasons. The new housing market is falling in both volume and price, and as the year draws to a close and developers seek to complete their annual sales targets, price reductions for sales will be more prominent. Home sales fell 17% in September, and infrastructure fixed-asset investment fell 4.5% y/y – the fifth consecutive month of negative growth. It is expected in the fourth quarter of the city new home prices will continue to fall.

Highly-leveraged developers were faced with new challenges when the government introduced its “three red lines,” which specify 1) that a property developer’s ratio of liabilities to assets must be below 70%; 2) its ratio of net debt to equity must be below 100%; and 3) its ratio of cash to short-term debt must be at least 100%. This brought new attention to the potential impact that a wave of property developer defaults might have on China’s growth. Evergrande has become the most famous example of this, but it’s not the only company in that situation. Last year, a number of Chinese state-owned companies including BMW’s Chinese partner Brilliance Auto Group, top smartphone chipmaker Tsinghua Unigroup, and Yongcheng Coal and Electricity defaulted on their loans. This raised fears about China’s reliance on debt-fueled investments to support growth and encouraged regulators to develop these new restrictions to curb debt growth and put caps on banks’ property lending.

Evergrande ran afoul of all three of these new red lines, though only 1 of China’s 15 largest developers was fully compliant with the new rules. Evergrande is a particularly newsworthy case as it is one of China’s largest real estate developers, and one of the most indebted developers in the world with more than $300 billion USD in liabilities, which is equivalent to nearly 2% of China’s annual GDP. Evergrande claims to own more than 1,300 projects in more than 280 cities across China, employing about 200,000 people and sustaining more than 3.8 million jobs each year.

China’s residential real estate market, including construction activity and services, accounted for about 23% of GDP in 2018, according to Goldman Sachs. The bank’s economists have estimated that a 15% drop in land sales and a 5% decline in property sales and home prices could knock 1.4% off China’s GDP. The real estate sector represents around 27% of Chinese bank loans, with real estate being the main form of collateral for loan securitization. Construction accounts for about half of China’s steel consumption, and iron ore prices have almost halved since late July when Evergrande’s problems intensified.

Central bank officials maintain that the spillover effect of Evergrande’s debt problems on the banking system is controllable and individual financial institutions’ risk exposures are not overwhelming. Broad efforts have been taken to determine the exposure of smaller regional banks that may carry debt from Evergrande, or even have the company as one of their shareholders. The new restrictions on debt levels may be painful for some companies, but they are a necessary measure to limit private debt from becoming a more widespread systematic challenge. While is it not yet clear if Evergrande could receive any substantial bailouts from the central government, there are indications that such measures might be made available to the smaller regional banks.

This situation has resulted in the slowdown of property sales with the waning confidence among home buyers. While total residential space sold has been significantly higher in 2021 compared to 2019 and 2020 from January up to June, those sales numbers for 2021 have dropped below both years in July. The demand that was not already met in the first half of the year is now facing concerns that developers won’t be able to complete new projects, with media reports about unfinished Evergrande projects and potential defaults adding to those fears. Lower sales volumes could prompt other developers to offer bigger discounts as a means to recoup cash to repay their own debt obligations, which could put downward pressure on housing prices.

While it may be challenging for existing homeowners, lower housing prices could be attractive to those still looking to buy their first home, who have seen urban residential properties quadruple in price from 2007 to 2018. The median home value in China has increased as high as 46.3 times the median family disposable income per year in the city of Shenzhen. This means residents of Shenzhen would have to spend 46 years saving all their disposable income to pay off the price of a home. This is compared to home prices being 21 times the median family disposable income in Paris, or 10.1 times in New York.

The consensus among analysts seems to indicate that authorities will be able to use temporary controls to prevent real estate prices from dropping too significantly, and ensure that prepurchased units will be completed. These measures will help to backstop the market and reassure home buyers. The clear indication from this is that the classic “growth-at-all-costs” approach to the economy is out, and a more inclusive, “higher-quality” growth with a stronger regulatory environment will be the trend moving forward.