China Economic Update 2023 Q1

China’s Gross Domestic Product (GDP) expanded at a faster-than-expected rate of 4.5 percent in Q1 of 2023, surpassing the 4 percent forecast in a Reuters poll. This marks the highest growth rate since Q1 of last year when the economy grew by 4.8 percent. After China abandoned its “zero-COVID” policy at the end of 2022, COVID infections quickly peaked, and the economy entered a period of fast recovery. Industrial output rose by 3.9 percent, and year-to-date fixed asset investment increased by 5.1 percent compared to the previous year. However, the real estate investment continued to decline, and growth in both manufacturing supply and demand softened last month. Furthermore, signs of a weakening rebound were visible in March as the foundation for economic recovery remained unstable. Moving forward, economic growth will still rely heavily on a boost in domestic demand, particularly an improvement in household consumption.

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI index) posted a neutral level of 50.0 in March, signaling stable business conditions at the end of Q1. Although market conditions continued to improve after the COVID-19 policy shift, a marginal slowdown in recovery was evident. One key factor dampening the headline PMI figure was a softer rise in manufacturing production. Furthermore, external demand weakened amid a global economic downturn, with the gauge for new export orders falling back into contraction. Employment also fell slightly in March as businesses reduced hiring to cut costs. Nonetheless, improved supplier capacity and inventory availability supported shortened lead times in March. Overall, surveyed companies remained highly confident in their economic outlook for 2023.

In terms of currency exchange rates, CAD/CNY was in an overall downward momentum in Q1 of 2023, hitting the one-year low of 4.97 CAD/CNY on March 24.

2024 Economic Outlook

The Economist Intelligence Unit (EIU), a subsidiary of The Economist Group, has revised its real GDP growth forecast for China in 2023 upward to 5.7 percent from its previous estimate of 5.2 percent. The EIU also predicts that China’s GDP growth in 2024 will be 4.8 percent, up from its earlier projection of 4.5 percent. The recovery is expected to be consumer-led, as pent-up demand for goods and services, including outbound tourism, is unleashed following the exit from the country’s zero-COVID policy. While the International Monetary Fund (IMF) maintained its GDP growth forecasts for China at 5.2 percent for 2023 and 4.5 percent for 2024, China’s economic growth profile in 2023 is likely to be characterized by a weaker first six months and a stronger second half. Reopening will not immediately result in an acceleration of growth; however, China’s economic momentum will likely build in the second quarter after a challenging first quarter, before a robust recovery sets in during the second half of the year. Global demand for Chinese exports is expected to recover in the second half of 2023, which will underpin stronger economic performance in 2024.

The Construction Sector

China’s National Bureau of Statistics (NBS) reported that the average new home prices in 70 major Chinese cities fell by 0.8 percent year-on-year in March 2022, following a 1.2 percent decline in the previous month. This marks the 11th consecutive month of decreasing new home prices, but the slowest pace of decline since June 2022. Beijing has been working on speeding up policy measures to support the ailing property sector, contributing to this moderate decline in prices.

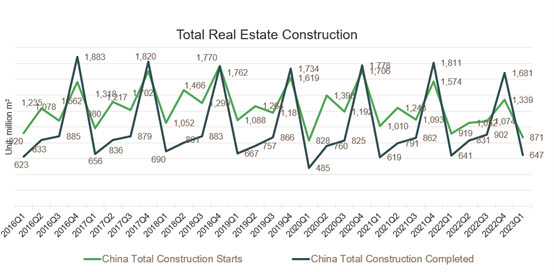

As seen in the chart above, the trend for total construction project starts and projects completed in Q1 of 2023 showed a mixed picture. The total floor area starts in China in Q1 2023 was 871 million m2, down 5.22 percent compared to the same period in 2022 (919 million m2). Meanwhile, the total floor area completed in China in Q1 2023 was 647 million m2, up 0.94 percent compared to the same period in 2022 (641 million m2). Despite some growth in completed projects, the construction sector continues to face challenges due to Beijing’s efforts to tackle the issues in the property sector.