China Economic Update 2021 Q4

China’s Gross Domestic Product (GDP) slowed to 4.0% in the fourth quarter of 2021 from a year earlier, delivering a full-year result of 8.1% growth. A resurgence of COVID-19 cases and a downturn in real estate are seen as the major factors that have restrained economic momentum. The growth reported for Q4 came in as the weakest quarterly results since the initial outbreak of COVID-19.

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI index) came in at 50.9 in December, up from 49.9 the previous month. Though marginal, this rate of improvement was the strongest seen since June, with supply improving and demand rebounding. Total new orders increased while overseas demand remained sluggish because of the impact of the Omicron variant in foreign countries, and rising logistics costs due to supply chain disruptions such as the shortage of containers and labour challenges. The gauge for new export orders stayed in contractionary territory for the fifth consecutive month.

Firms have remained cautious about hiring, with the subindex of employment staying in negative territory for the fifth consecutive month in December and hitting the lowest point since February. Unemployment rates have returned to pre-pandemic levels, but with 7.97 million graduates in 2020 entering the job market, there is a significant demand for new job opportunities each year. Despite a focus on domestic consumption as a potential growth engine, retail sales only grew by 1.7% in December, missing expectations by analysts at Reuters who had predicted a 3.7% increase.

Data released by the General Administration of Customs showed goods exports rising by 20.9% year-on-year in December, compared with a 22% jump in November. Imports increased by 19.5%, following a 31.7% gain the previous month. Exports rose by 29.9% in 2021 to $3.36 trillion USD in 2021, while imports increased by 30.1% to $2.6 trillion USD. The Economist Corporate Network (ECN) expects that trade growth will moderate in 2022, given expectations of softer overseas demand.

As policymakers said at the Central Economic Work Conference hosted by the Central Government, China’s economic growth is facing triple pressures of “demand contraction, supply shock and weakening expectations.” The uncertain trajectory of the ongoing global pandemic, as well as strained supply chains remain as key challenges for the year ahead. Stabilizing the economy will be a key priority of economic work in China for 2022.

While the 4.0% growth for Q4 of 2021 can be seen as a slowdown, a report in Yicai Global by Mark Kruger highlights the importance of quarter-on-quarter figures. In the fourth quarter, real GDP grew by 1.6 percent, which had exceeded 2019’s average of quarter-on-quarter growth of 1.4 percent. China faced substantial challenges in Q3 such as power rationing and shortages in microchips that affected auto manufacturing as well as electronic goods. Those bottlenecks have been largely resolved, with increases in coal imports and coal mining to ensure adequate supplies while fossil fuel remains a primary energy source for the country. Auto production grew in December for the first time since April, up by 3.4% year-on-year, while industrial production rose by 4.3%.

In terms of the currency exchange rates, CAD/CNY experienced a drop in Q4 2021, with 1 CAD dropping from 5.2 CNY to 4.92 as CNY strengthened.

2022 Economic Outlook

The Economist Intelligence Unit (EIU) under the Economist Group expects that China’s real GDP will moderate to 5.3% in 2022, and economic policy will likely shift to loosening measures to stimulate growth. Continued recovery in private consumption is an important target for growth while deleveraging in the property sector and the drive to regulate the technology sectors are expected to continue. China’s research and development expenditure rose 14.2 percent year-on-year, which was four percent higher than the growth in 2020. R&D expenditure currently accounts for 2.44 percent of GDP, which reinforces the national emphasis on innovation.

The deleveraging efforts have borne fruit, with the debt-to-GDP ratio reduced by 10 percentage points in 2021 according to Morgan Stanley, which is a magnitude not seen since the 2003 to 2007 period. Morgan Stanley predicts 5.5% growth in China for 2022, while Nomura estimates 4.3%, Deutsche Bank estimates 5%.

In January 2022, Goldman Sachs cut its annual forecast. “In light of the latest COVID developments – in particular, the likely higher average level of restriction (and thus economic cost) to contain the more infectious Omicron variant – we are revising our 2022 growth forecast to 4.3%, from 4.8% previously,” Goldman Sachs analyst Hui Shan stated in a report. The International Monetary Fund (IMF) has also downgraded its forecast by 0.8 points from 5.6% to 4.8% growth. China is expected to maintain a zero-Covid approach to the pandemic, which is especially challenging with the Omicron variant at time when the Spring Festival is about to begin, a holiday often referred to as the largest human migration on earth where hundreds of millions of people travel to visit their families. This year, the festivities will overlap with the Beijing Winter Olympics. As of January 24, 2,586 personnel have arrived in Beijing, including athletes, officials, members of the IOC and members of the press. Brian McCloskey, chair of the Beijing 2022 Olympics medical expert panel, said at an online media briefing that 72 COVID-19 cases have been detected so far, which is comparable to infections at the Tokyo 2020 Olympics. Around 5,000 international arrivals are expected for the games.

While those arrivals to be limited within the Olympic “bubble” that will be separated from the local public, notices have been sent out to discourage travel during the Spring Festival and strict policies are being maintained to suppress the risk of imported outbreaks. There are some predictions that more people will travel home for the holidays than what was seen in 2021, but this would be going against government advisory notices to avoid non-essential travel, and with COVID restrictions changing every day at the local level. Some travellers might find themselves being told to quarantine for 14 days when they arrive in their hometown if they left from a region where any new cases are found. The Omicron variant has been identified in some new domestic cases, which has triggered rapid lockdowns in the associated areas. These COVID-19 flare-ups will dampen the consumer activity typically associated with the Spring Festival, and questions remain as to how sustainable the zero-Covid approach will be over the long term.

The Construction Sector

According to the NBS, the average new home prices in China’s 70 major cities declined 0.2% in December from a month earlier, which was a slower drop than the 0.3% decline in November. China’s property market has slowed since June 2021 as regulators stepped up their deleveraging campaign for the sector, triggering defaults at some heavily indebted companies. Investor confidence was shaken as developers hit cash flow limits with the new restrictions on debt and financing. This caused delays in some projects under construction, and cancellations in cases when the developer went into default. In a few cases, home buyers and investors protested at the offices of developers when they didn’t know when or if they’d get their investments back.

The decline has moderated as authorities and property developers in multiple cities introduced measures in December to help guarantee that new projects will be finished in efforts to boost home sales. Local governments relaxed some of the restrictions on purchasing property while real estate firms have been offering discounts and banks have increased mortgage loans with lower lending rates. Authorities have also loosened some of the restrictions on developers being able to issue bonds, which helps them to be able to invest in new projects.

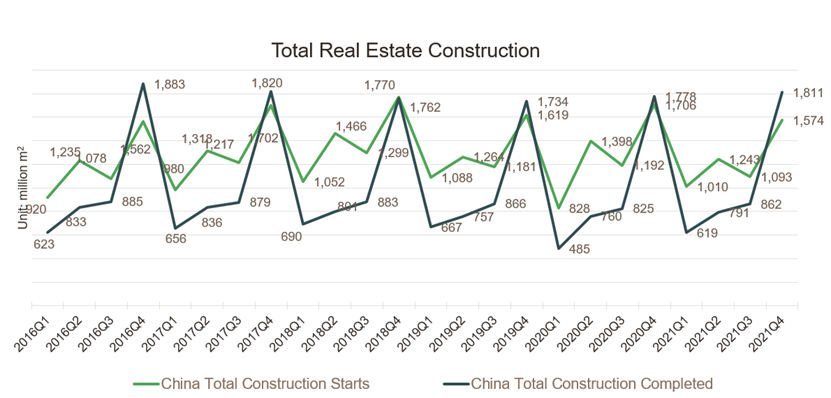

The chart above shows the trend for total construction project starts and the total projects completed in the corresponding quarter. The total floor area starts in China in Q4 2021 was at 1,574 million m2, down 7.7 percent compared to the same period in 2020 (1,706 million m2). Construction starts had dropped 16.8% in October, which was a significant motivator for authorities to relax some of the new restrictions and implement measures to aid developers. The total floor area completed in China in Q4 2021 was at 1,811 million m2, growing 1.2 percent compared to the same period in 2020 (1,788 million m2).

Ma Jun, a senior advisor to the central bank of China, noted in a speech that two important real estate statistics remain prominent to economic planning in China. Local governments derive 37% of their total revenue from land sales, and 67% of personal wealth in China is tied to the real estate sector. While efforts to deleverage the sector and control debt will continue, those efforts will moderate to ensure stability. A question lingering in the background is when a property tax might be implemented, and what that might look like. The lack of a property tax has been a factor for wealthy families using property as an investment asset base, which has driven up prices and made it difficult for those looking to try to purchase their first home. With common prosperity being highlighted as a fundamental target for economic development over the coming years, the disparity between average home prices and average annual salaries remains a prominent challenge.