South Korea Economy and Housing Market Update for Q3 of 2022

3rd Quarter of 2022 – South Korea Economy:

South Korea’s economy grew at its slowest pace in a year in Q3 as poor net exports offset consumption and investment.

- GDP grew 0.3% in Q3 slowing from a 0.7% gain in Q2.

- Exports expanded 1% in Q3 from Q2, a turnaround from 3.1% contraction in Q2.

- Imports rose 5.8% in Q2, compared with a 1% fall in Q2.

- Private spending expanded 1.9% on-quarter in Q3, but the face of growth slowed from 2.9% gain in Q2.

- Government spending also slowed from a 0.7% advance to a 0.2% rise.

- Facility investment jumped 5% in Q3, compared with a 0.5% increase in Q2.

2022 – 2023 Growth Outlook:

South Korea’s economy could grow 2.6% annually for 2022 if the economy avoided negative growth in Q4.

OECD cuts South Korea’s 2023 growth outlook to 2.2% from earlier forecast of 2.8%, citing uncertainties in the global economy.

OECD also raised 2023 inflation outlook for South Korea to 3.9% from the previous 3.8%.

South Korea Housing & WF Construction:

Real Estate Market Condition & Responding Government Policies:

- The South Korean Government will continue to prioritize the increase of housing supply by lowering construction regulations in densely populated urban areas and support the redevelopment projects to stabilize the market.

- President Yoon earlier vowed an overhaul of the real estate policy, saying the previous government’s pursuit of tougher regulations and heavier taxes to curb speculation ended up causing a surge in housing prices.

- Home prices showed downward trends in recent months as housing transactions remained sluggish amid rising interest rates and concerns about an economic slowdown.

- As a countermeasure, the Yoon administration plans to carry out eased lending rules for first-time homebuyers and owners of one home as the once red-hot housing market appears to be entering a downturn amid rising interest rates and will soon unveil its first package intended to stabilize the housing market that includes the supply of more than 2.5 million houses through development projects led by the public sector including the state-run Korea Land and Housing Corp. and Seoul Housing & Communities Corp. to alleviate the housing shortage and tackle price escalation.

3rd Quarter of 2022 – South Korea Housing Starts and Permits:

- South Korea’s Housing Starts in number of units and total floor areas for Q3 of 2022 decreased 26.1% to 294,059 units and 17.1% to 27.69 million square meters respectively from a year earlier.

- However, owing to the Yoon administration’s policy toward small sized housing for the first-time home buyers, newlyweds, low-income people and young generation, Housing Permits in number of units and total floor areas for Q3 of 2022 increased 5.9% to 380,200 units and 16.8% to 48.81 million square meters respectively from a year earlier.

3rd Quarter of 2022 – South Korea WF Construction:

- Due to the sharp rise in the price of building raw materials, the market for all residential buildings, including wood residential buildings, is shrinking.

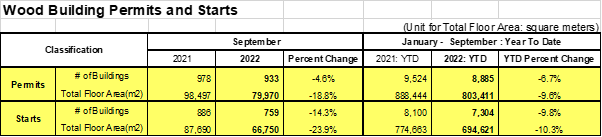

- The number and total floor area of Wood Building Starts for Q3 of 2022 decreased 9.8% to 7,304 buildings and 10.3% to 694,621 m2 from a year ago and those for Wood Building Permits also decreased 6.7% to 8,885 buildings and 9.6% to 803,411 m2.